If we think about the mobility landscape the novel ideas come through automation combined with something physical. Self-operating drones as a fine example. Ground transportation is being filled with autonomous cars and shuttles. Some companies present ground transportation in layers above the ground. One of the companies is Finnish UDT Technologies which is presenting a service ecosystem that consists of stations, air track, and transportation capsules.

Urban Track system in its multifunctional form can uniquely serve citizens and service providers. Physically connected city hubs offer fast and safe travel in urban city centers as well as in recreational areas or airports, to name a few.

UDT Technologies has agreed with the city of Lahti, Finland to build the first living lab environment for technology and service development. City officials have also thought about how the Urban Track will serve a larger area and connect thousands of citizens to important places, attractions and businesses.

UDT Technologies provides attractive scenarios for public- and shared transportation. “We offer the fastest, personal, and cheapest way to travel inside cities, it will have the lowest running costs. Systems will have short payback time and investment from the public can be very low.”, states Innovation Director Jussi Niemioja. Urban tracks are pollution-free, and it will free up space at the ground level. Double benefit – while zero-emission travel on the track is evident, but the ground-level efficiency will also increase as there will be less traffic.

Profitable part of public transport

While the investment into the service ecosystem has a payback time and subvention is not needed it is estimated that the overall impact will benefit widely the surrounding area. Accessibility improvement in the city will have a significant positive impact. “We offer 24/7 services and aim to cover important places. This enables families to own fewer cars for example. Maintenance on roads will be less. Air quality will improve. And most likely land value will increase as Urban Track have a similar nature and effect as other rail-based solutions”, says Jussi Niemioja.

Roads in general are the key to almost all activities happening in cities. No matter if it’s walking, cycling, delivery trucks or other means. UDT Technologies will pioneer an Urban Track ecosystem which would be an open platform for automated city logistics. Present available technologies including 5G, connectivity of people, applications in mobile phones, and cloud services enable very unique and new approaches to how closed systems can be built to serve citizens. Jussi Niemioja also expresses: “Our citizen-centric approach has proven to be efficient way to present our vision and several places are considering us as an attractive alternative. We connect people, deliveries and other services.”

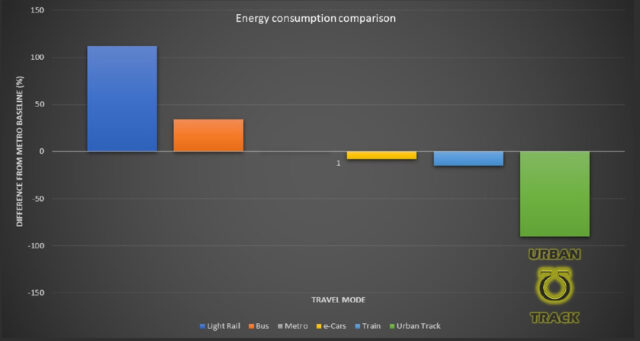

High efficiency – Towards zero emissions and less waste

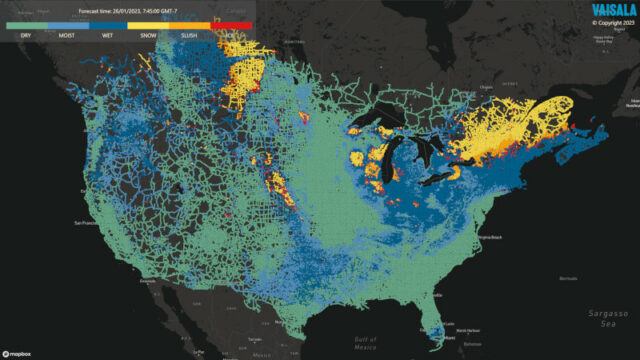

UDT Technologies is just about to publish a study in co-operation with LUT University that states energy consumption comparison to EV’s will be 1/10 or against electrified light rail 1/20. Comparison has been made based on data available publicly from Helsinki. Jussi Niemioja also highlights: “Emissions are a real challenge, is it CO2 emissions or health effecting small particles. Transportation is causing a significant part of that, and there is no sign of impactful decrease or decrease at all in the field of transportation. Correctly designed and placed Urban Track system can start the reduction in emission fees and improve air quality. We enable electrified transport and superior efficiency to be added into present system.”

Safe, lively, and accessible cities are among the top titles’ cities are promoting themselves. UDT aims to hit that spot. Less accidents, safe spaces, and more freedom at ground level. Still maintaining the freedom to travel and keep places lively and crowded. It is evident, that businesses will bloom when people have access to them, it also has lots of benefits in positive social impact. ‘Freedom to travel’ as they say.

UDT’s next steps are moving forward to implement the technology connecting the University campus in Lahti to the local Science Park. Second phase is to connect residential and commercial areas to the same system. After the concept is proven and the benefits are shown we have a wide audience to visit our site from Nordic region and further. We and they are waiting for it, together.

Further information:

Jussi Niemioja

Innovation Director, Chair of the Board

UDT Technologies

Mob: +358 50 405 9185

https://www.scaleuplaunchpad.eu/post/paving-the-way-for-a-new-era-in-urban-transportation